Description

PeerStreet Reviews – Round Up:

Quick Stats:

About PeerStreet

PeerStreet provides accredited investors with access to a vast portfolio of high quality private real estate loans and offers examples where investors earn a 6-9% yield over 12 months.

With carefully vetted borrowers, homes and through partnerships with large scale private lending organizations, PeerStreet investors are protected from many of the debt quality and default / sub-prime issues facing real estate lenders. Advanced analytics, and actual human investigations ensure only the safest loans are offered to their investor market.

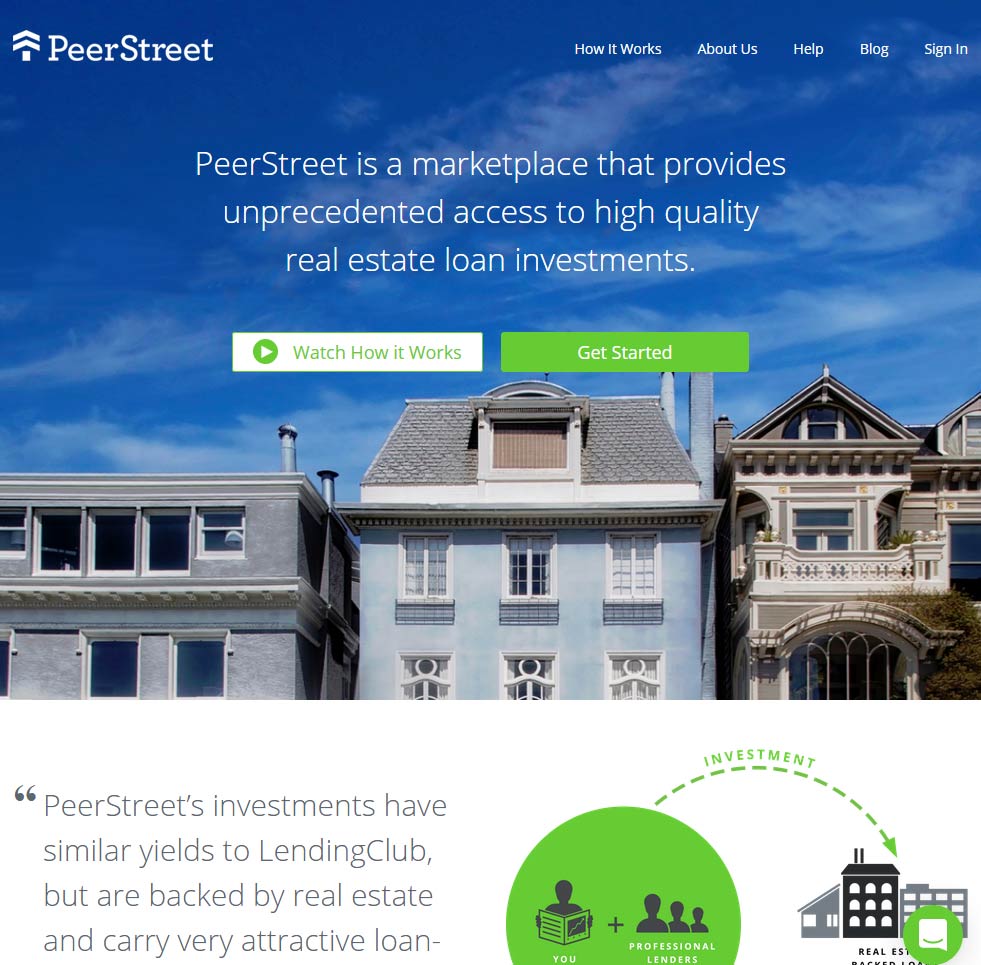

From the PeerStreet website:

PeerStreet is a marketplace that provides unprecedented access to high quality real estate loan investments. The PeerStreet team’s extensive expertise in real estate and big data analytics gives us an edge in providing an innovative way for investors to access real estate loans.

Debt is the safest type of real estate investment. It’s senior to the borrower’s equity, providing a cushion that protects the lender’s investment.

Dennison –

Peer Street has given me a better return than the bank. I have several investments in other areas but this is a first for property. Will see how things progress and will look to increasing my investment in the future.

V.L. –

I thought I’d looked into most investments and had a good range in my portfolio. Performance had been decent but not mind-blowing. I had some savings and was getting nothing from the bank on them so when a friend suggested Peer Street I was very interested. I already have real estate investments but am wary of a downturn. It’s a very clever idea and so far has outperformed any of my cash accounts and many of my other assets, with the added benefit it’s actually helping people buy homes.