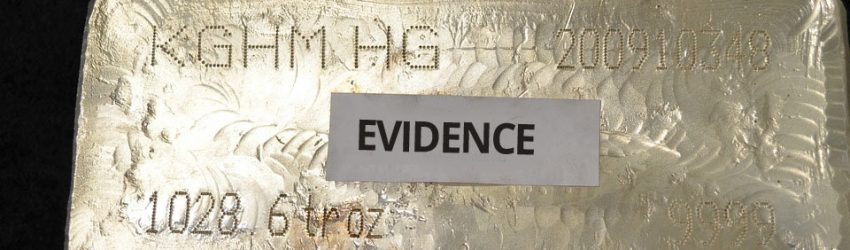

Defendants are alleged to have fraudulently sold contracts of sale of silver in a nationwide scheme

The U.S. Commodity Futures Trading Commission (CFTC) announced the filing of a federal civil enforcement action charging defendants Ronnie Gene Wilson (Wilson) and Atlantic Bullion & Coin, Inc. (AB&C), both of Easley, S.C., with fraud in connection with operating a $90 million Ponzi scheme, in violation of the Commodity Exchange Act (CEA) and CFTC regulations.

The CFTC’s complaint charges violations under the agency’s Dodd-Frank authority prohibiting the use of any manipulative or deceptive device, scheme, or contrivance to defraud in connection with a contract of sale of any commodity in interstate commerce in violation of Section 6(c)(1) of the CEA, as amended, to be codified at 7 U.S.C. §§ 9, 15 and the CFTC’s implementing Regulation 180.1 (a).

According to the complaint, since at least 2001 through February 29, 2012, Wilson and AB&C operated a Ponzi scheme, and, as part of the scheme, fraudulently offered contracts of sale of silver, a commodity in interstate commerce.

Through their 11-year long scheme, the defendants allegedly fraudulently obtained at least $90.1 million from at least 945 investors for the purchase of silver.

From August 15, 2011, through February 29, 2012 – the time period during which the CFTC has had jurisdiction over the defendants’ actions under new provisions contained in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 – the defendants allegedly fraudulently obtained at least $11.53 million from at least 237 investors in 16 states for the purchase of contracts of sale of silver.

The complaint further alleges that during this period, the defendants failed to purchase any silver whatsoever.

Instead, the defendants allegedly misappropriated all of the investors’ funds and to conceal their fraud and issued phony account statements to investors.

In its continuing litigation, the CFTC seeks restitution to defrauded investors, a return of ill-gotten gains, civil monetary penalties, trading and registration bans, and permanent injunctions against further violations of the federal commodities laws.

Leave a Reply