Description

MoneyLion Reviews – Round Up:

Quick Stats:

About MoneyLion

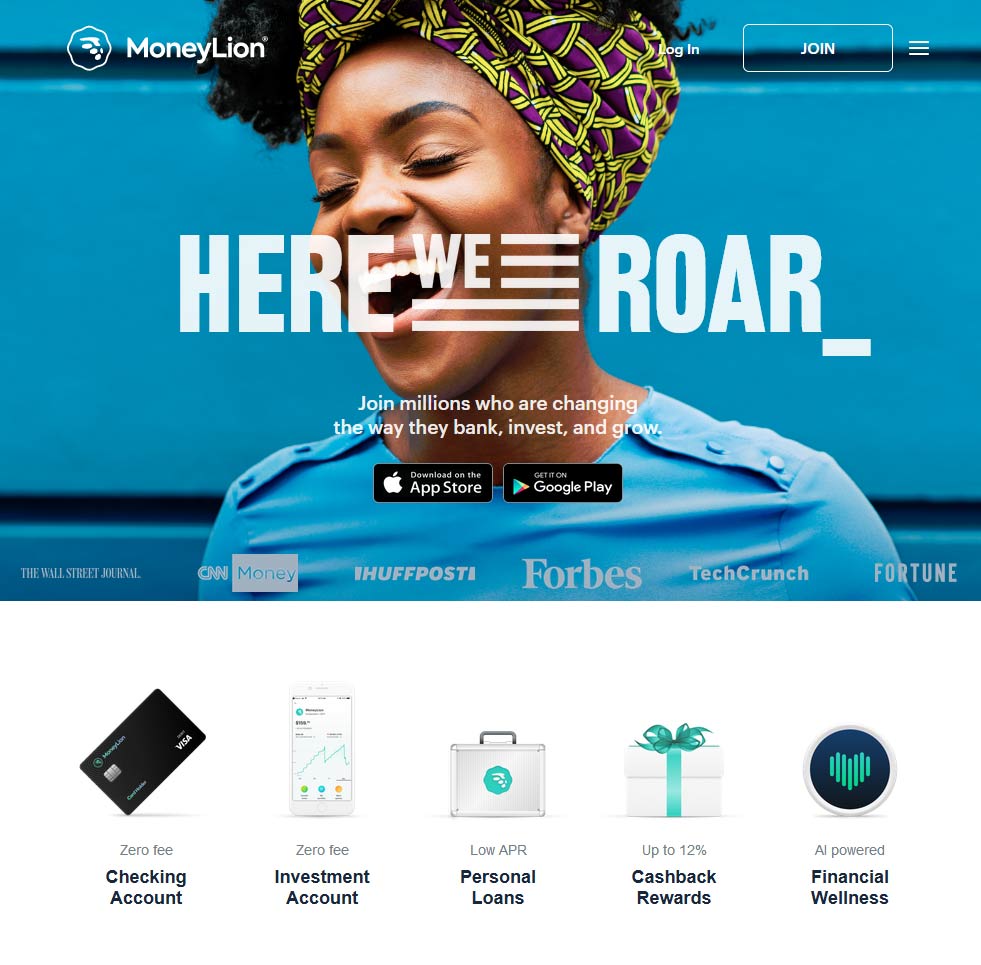

Although MoneyLion offer a wide range of bank-like services from zero-fee checking or investment accounts, it’s their free 0% APR cash advances and low APR credit-builder loans that are of special interest here.

Claiming to do all the things that banks do, but better (and cheaper) MoneyLion has rapidly gained a huge customer base with over 4M users and $7.2M saved in bank fees. They also provide free credit monitoring and lots of education materials for credit repair and better credit scores.

From the MoneyLion website:

MoneyLion was founded in 2013 to make money more approachable and to empower consumers to take greater control of their financial lives. We believe that by building better, smarter products we can help people to build positive, sustainable financial habits.

We believe in empowering each other. We believe in inclusion. We believe in simplicity.

Clara –

Fair service but a lottery on who you get helping you. My first “helper” was rude and dismissive and I was all for going elsewhere. My second attempt I was lucky to be put through to one of the best customer service agents I’ve dealt with in my life who not only answered all my questions but gave me a roadmap on what steps I could take to fix my issues. I am in the process of opening an account and so far (first misstep apart) all is looking to be very good.

Effie –

I had a small problem with my account and from that moment on it ballooned with people saying they’d do things they never did, people not calling me, people not leaving notes for other people. Does anyone know what’s going on over there? I had enough and tried to close my account. Could they even get that right? Hell no. Worst experience. Of. My. Life.

Elise –

Too complicated process there are easier ways to up your score