Description

LendingClub Reviews – Round Up:

Quick Stats:

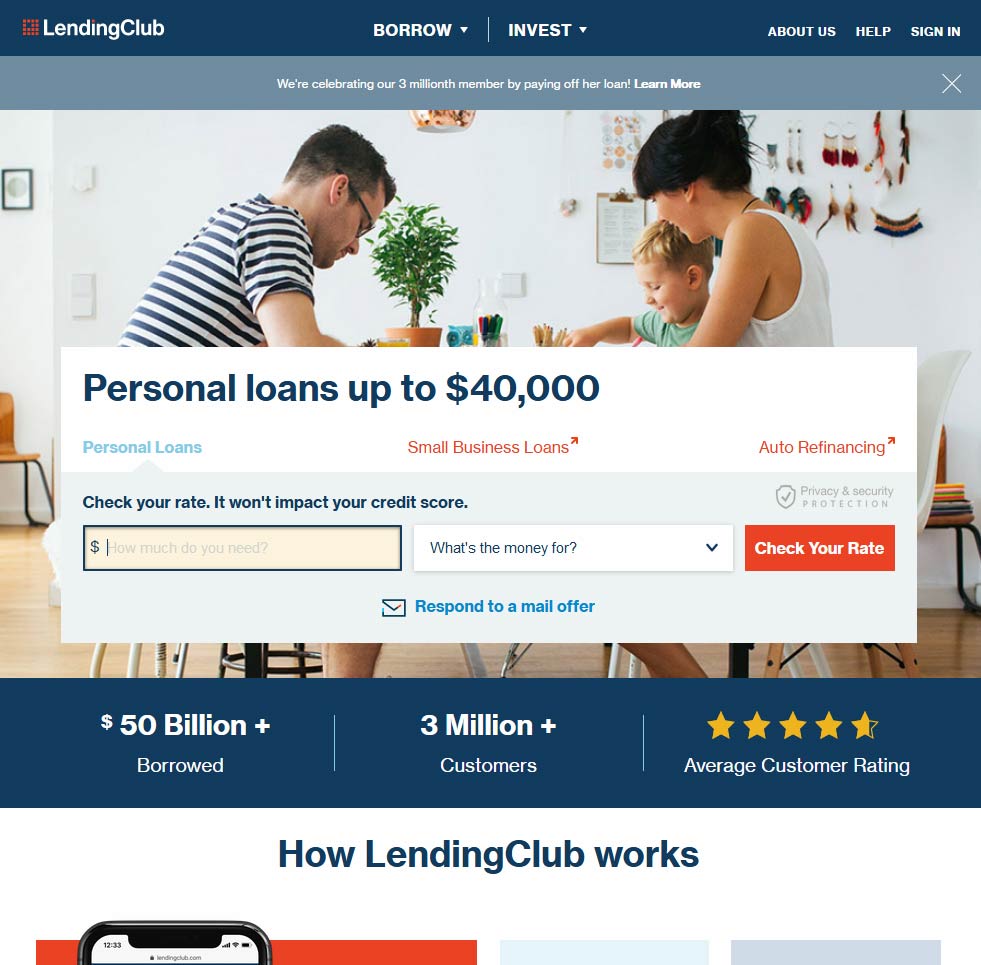

About LendingClub

LendingClub is one of a growing number of “peer-to-peer” lenders – businesses based on helping individual borrowers borrow money directly from individual “investors”, that is people looking to invest their money in the loans made to the borrowers.

Established 2007, with a large (and growing) network of smaller private investors – and innovative technology to best place key funds with key borrowers, LendingClub has helped lead the way in this new area of ethical lending. They offer personal loans of up to $40,000 and business loans of up to $500,000 – as well as specialist lending such as health and auto-refinancing, all at a comparatively modest cost.

From the LendingClub website:

At AmOne.com, we’re a free service that makes it faster and easier for consumers and small business owners of all credit situations to get matched with great loan programs.

Our website uses innovative technology to quickly match your request with our network of highly rated lenders available nationwide, to find available options. With so many great personal loans and small business loan programs available in one place, you’ll receive safe, reliable options you can count on, without having to spend hours searching for them on your own!

Colin –

High interest rates but broadly in line with other “bad-credit” lenders. Where they win is speed and apart from an administrative error everything went well