FTC charges mortgage loan modification operation with deceiving financially distressed homeowners, halting the scheme and freezing the defendants’ assets

Found Guilty – Latest

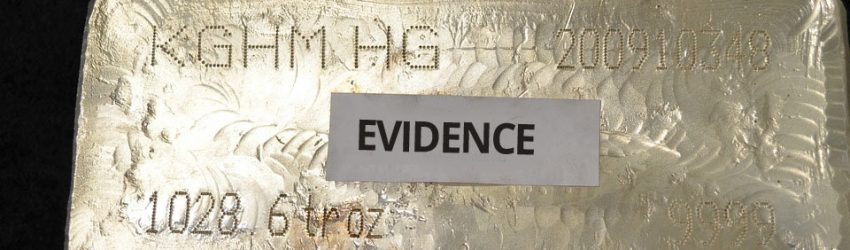

Scammers get what’s coming when the law catches up to them and it all goes wrong in court!

FTC challenges Lending Club’s “No Hidden Fees” claims, despite Lending Club taking a hefty portion of the Loan Amount up front as an origination fee.

Taking in in more than $100 million by marketing lots in what the defendants said would become a luxury development in Belize, the scheme was known by several names, including Sanctuary Belize, Sanctuary Bay, and The Reserve.

Operators of a scheme that sold “secrets for making money on Amazon” banned from marketing and selling business opportunities under a settlement with the FTC, and they will surrender millions of dollars for return to consumers.

Fat Giraffe Marketing, four related Utah-based corporations, Gregory W. Anderson, and Garrett P. Robins marketed money-making opportunities, claiming that people could rake in cash from the comfort of their homes simply by posting advertising links on websites.

The FTC has closed down student debt relief companies Mission Hills Federal and Federal Direct Group amidst claims of fraud and deception

The FTC is mailing checks totaling nearly $1.1 million to 87,256 consumers who paid for work-at-home opportunities based on the allegedly deceptive advertising practices of Bob Robinson, LLC and other related defendants.

Co-conspirators identified distressed homeowners who were in default on mortgages or were experiencing financial troubles, even though some had large amounts of equity in their properties.

In what is the largest amount ever sent in a refund program run by the FTC there is $505 million coming back for payday loan customers of AMG

The Federal Trade Commission is mailing 474 checks – more than $33,000 to consumers who lost money to a scheme that charged homeowners an up-front fees but never provided any services.